As Naomi Jagoda reported in The Bond Buyer yesterday ($), the National Association of Bond Lawyers has asked the IRS to revoke Advice Memorandum 2014-009, in which the IRS concludes that if you defease BABs with tax-exempt bonds, the BABs are treated as retired and reissued and are therefore no longer eligible for subsidy payments because the new issue date is past the BABs deadline.

We have discussed this controversy several times in the past. The essence of the matter is that a defeasance of a “tax-exempt bond” doesn’t cause a reissuance of that bond, and the IRS thinks that a BAB, which bears interest that isn’t tax-exempt, doesn’t qualify for the exception. We’ve focused on why the result in the Advice Memo doesn’t make a whole lot of sense for various policy reasons. The NABL letter also provides a compelling case for why the Advice Memo is wrong. And as Mark Leeds of Mayer Brown and Donny McGraw of Macquarie Capital noted in their recent article in the February 11, 2015, Daily Tax Report ($), “the fact that the IRS could cite to its own inaction in updating a regulation as the basis for not treating the BABs as tax-exempt obligations seems self-serving and inappropriate.”

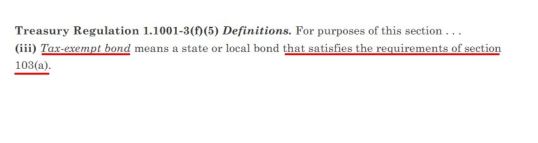

But let’s not over-complicate things – when all else fails, look at the text:

And then:

Now for the big finish:

Q.E.D.